by 3D Accounting | May 20, 2022 | blog

In the last few years, the amount of retail investors trading the share market and/or crypto has exploded. At 3D we have seen this ourselves, with a lot of clients new to this investment space. So, a few things you need to be aware of: 1. The ATO know everything you...

by 3D Accounting | Mar 30, 2022 | blog

Well, as accountants it’s nice to have a year when post-budget we can say there haven’t been any drastic changes. Most of the positives from the budget have been already been headlined in mainstream media, but here they are again in 3D speak: Fuel excise tax...

by 3D Accounting | Mar 22, 2022 | blog

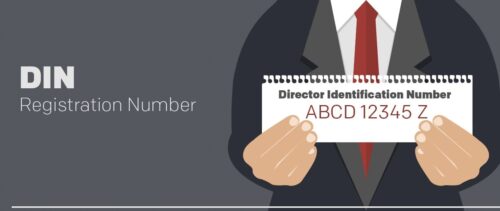

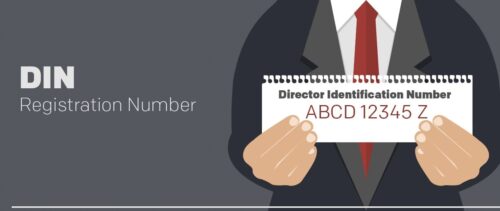

A director’s identification number is a unique identifier that is given to a director to prevent the use of false or fraudulent director identities. A director’s ID is required by law and applications will need to be made through the Australian Business Registry...

by 3D Accounting | Dec 15, 2021 | blog

Tahlia Miller has been an exceptional asset to the 3D team for over ten years now, and although she has held a Business Diploma for six years, an Accounting Degree for three years (graduated with a Distinction), Tahlia just recently completed the higher level CPA...

by 3D Accounting | Dec 13, 2021 | blog

Well, another year has flown by just like that. The team has built up a stack of holidays and so we are taking an extended break this year, our last day will be Thursday the 23rd of December, and we will re-open Monday 17th January 2022. If anyone needs...