by 3D Accounting | Jul 8, 2025 | blog

Happy New Financial Year to you all! Due to a mix of staff changes and illness this week, we have adjusted our office hours for the next few days. Our updated hours will be as follows: Wednesday 9 July – 8:30am to 4:30pm Thursday 10 July – 8:30am to 4:30pm Friday 11...

by 3D Accounting | Jun 25, 2025 | blog

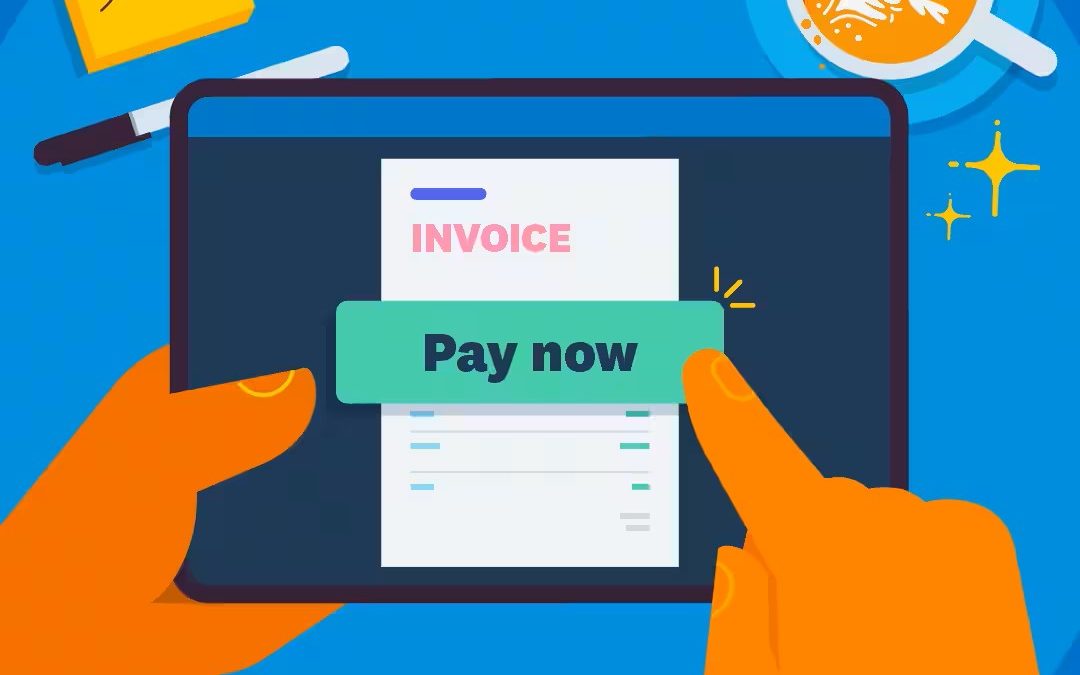

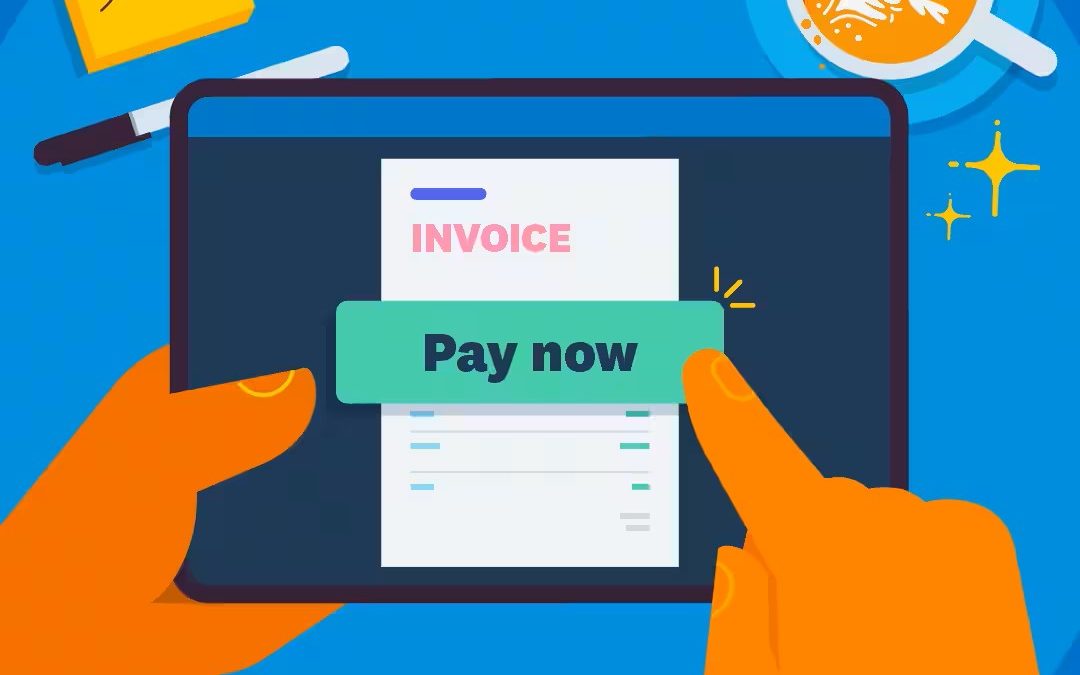

You may have noticed something new!! At 3D Accounting, we are always looking for ways to enhance your experience and streamline our services. We are thrilled to announce the launch of our new billing system powered by Xero, designed to make your payment process more...

by 3D Accounting | Jun 2, 2025 | blog

We recently reviewed our cyber insurance here for the firm, and whilst going through that process we found some interesting things which we believe are relevant to all businesses. Did you know one of the most common claim request on business insurance is for...

by 3D Accounting | May 21, 2025 | blog

Working out your employee’s long service leave (LSL) entitlement can be a minefield. With so many factors to consider when it comes to calculating this, it’s no wonder this task can be overwhelming. To help clear up some of the common questions around LSL, we’ve put...

by 3D Accounting | Apr 14, 2025 | blog

Due to the timing of Easter and Anzac Day public holidays, our office has decided to close for an extended break. Our office will be closed from Thursday 17th April at 5:00pm, and we will re-open on Monday April 28th at 8:30am. If there are any urgent matters, please...